The Basic Principles Of Stonewell Bookkeeping

Wiki Article

9 Easy Facts About Stonewell Bookkeeping Shown

Table of ContentsThe Facts About Stonewell Bookkeeping UncoveredSome Known Details About Stonewell Bookkeeping Excitement About Stonewell BookkeepingSome Known Details About Stonewell Bookkeeping Stonewell Bookkeeping Fundamentals Explained

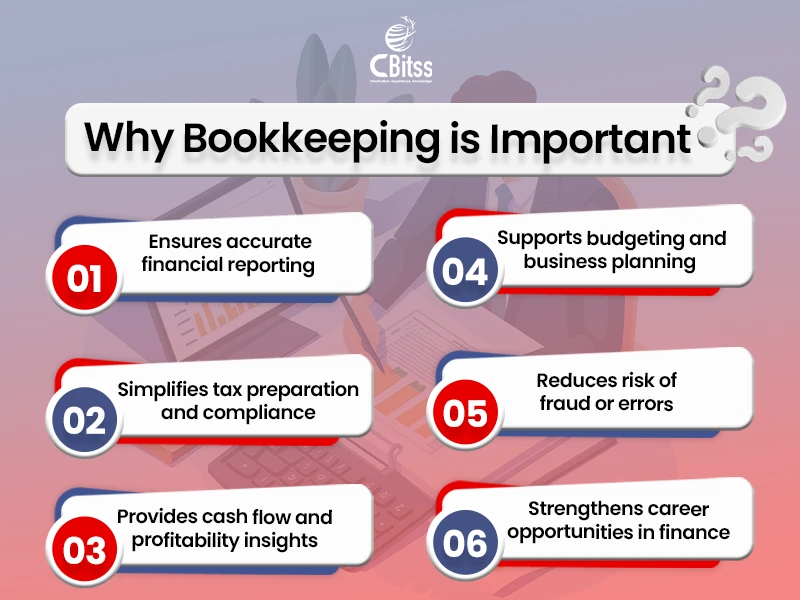

Here, we answer the inquiry, exactly how does accounting help a service? Real state of a company's finances and capital is always in flux. In a sense, accountancy publications stand for a picture in time, yet just if they are upgraded usually. If a company is absorbing little, an owner should do something about it to increase earnings.

None of these verdicts are made in a vacuum cleaner as accurate numerical details need to buttress the economic choices of every small business. Such information is put together through accounting.

You recognize the funds that are readily available and where they fall short. The news is not constantly excellent, however at the very least you recognize it.

Some Of Stonewell Bookkeeping

The maze of deductions, credit reports, exemptions, timetables, and, certainly, charges, is adequate to simply give up to the internal revenue service, without a body of well-organized documents to sustain your insurance claims. This is why a specialized bookkeeper is very useful to a tiny organization and deserves his or her weight in gold.

Your company return makes insurance claims and representations and the audit focuses on verifying them (https://anotepad.com/notes/qmk5gfhb). Good bookkeeping is all concerning attaching the dots between those representations and truth (bookkeeping services near me). When auditors can comply with the information on a ledger to receipts, bank declarations, and pay stubs, among others papers, they quickly learn of the competency and integrity of the business company

Indicators on Stonewell Bookkeeping You Should Know

In the same method, careless bookkeeping adds to stress and anxiousness, it additionally blinds entrepreneur's to the potential they can recognize over time. Without the information to see where you are, you are hard-pressed to set a destination. Just with reasonable, detailed, and valid information can a local business owner or administration group story a training course for future success.Company owners know ideal whether an accountant, accounting professional, or both, is the ideal remedy. Both click resources make essential payments to a company, though they are not the very same occupation. Whereas a bookkeeper can collect and organize the information required to sustain tax obligation preparation, an accountant is much better suited to prepare the return itself and truly assess the income statement.

This article will delve right into the, including the and exactly how it can profit your service. We'll also cover exactly how to start with bookkeeping for an audio economic ground. Bookkeeping entails recording and organizing monetary purchases, including sales, purchases, settlements, and invoices. It is the procedure of maintaining clear and concise records to make sure that all financial details is quickly obtainable when required.

This article will delve right into the, including the and exactly how it can profit your service. We'll also cover exactly how to start with bookkeeping for an audio economic ground. Bookkeeping entails recording and organizing monetary purchases, including sales, purchases, settlements, and invoices. It is the procedure of maintaining clear and concise records to make sure that all financial details is quickly obtainable when required.By frequently upgrading economic records, accounting assists companies. Having all the financial details easily available maintains the tax obligation authorities satisfied and avoids any final migraine during tax obligation filings. Regular bookkeeping makes sure properly maintained and orderly documents - https://giphy.com/channel/hirestonewell. This aids in easily r and saves organizations from the stress of searching for records during deadlines (Bookkeeping).

3 Easy Facts About Stonewell Bookkeeping Shown

They are mostly concerned concerning whether their money has actually been utilized appropriately or not. They definitely would like to know if the firm is making money or not. They also would like to know what potential business has. These aspects can be easily taken care of with accounting. The earnings and loss statement, which is prepared routinely, shows the revenues and also identifies the prospective based on the earnings.Thus, bookkeeping aids to prevent the troubles related to reporting to financiers. By maintaining a close eye on economic documents, companies can set reasonable objectives and track their progression. This, in turn, cultivates much better decision-making and faster company growth. Government laws commonly call for businesses to maintain financial records. Normal accounting makes sure that organizations remain certified and stay clear of any charges or lawful concerns.

Single-entry accounting is straightforward and functions best for small companies with couple of deals. It does not track assets and obligations, making it less extensive contrasted to double-entry accounting.

Stonewell Bookkeeping - Questions

This might be daily, weekly, or monthly, depending on your service's size and the volume of purchases. Don't think twice to look for help from an accounting professional or bookkeeper if you locate managing your economic documents testing. If you are seeking a complimentary walkthrough with the Audit Remedy by KPI, call us today.Report this wiki page